Repair Shops Continue to Navigate ADAS Challenges

Automotive repair shops are grappling with the complexities of Advanced Driver Assistance Systems (ADAS), but data from IMR Inc. reveals that most are managing these challenges effectively without turning away significant business. A recent survey highlights key insights into how shops are adapting to the demands of ADAS-related repairs.

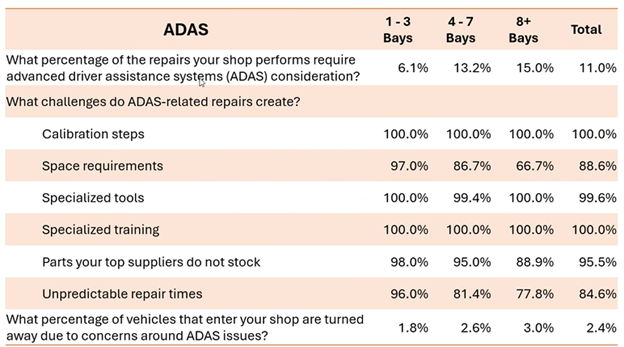

The survey, targeting shops of varying sizes—categorized by the number of service bays (1-3, 4-7, and 8+ bays)—found that 11% of all repairs performed across these shops require consideration of ADAS technologies. Larger shops with 8+ bays report a higher percentage at 15%, compared to 13% for 4-7 bays and 6% for smaller 1-3 bay operations, indicating a correlation between shop size and ADAS repair volume.

However, ADAS repairs present several challenges. Universal issues include calibration steps, specialized tools, and training, with 100% of respondents across all shop sizes acknowledging these as critical hurdles. Space requirements, while still significant, vary by shop size, with 97% of 1-3 bay shops citing it as a challenge, dropping to 67% for shops with 8+ bays. Additionally, 96% of shops report difficulties obtaining ADAS parts from top suppliers, and 85% note unpredictable repair times as a concern, particularly among smaller shops (96% for 1-3 bays).

Despite these obstacles, shops are turning away only 2% of vehicles due to ADAS-related concerns, with larger shops (8+ bays) seeing a slightly higher rate at 3%, compared to 1% for smaller operations. Among the 2% of vehicles that are turned away specifically for ADAS difficulties, 71% are sent on to dealerships, which are considered to be better equipped to handle the technology.

Moreover, 81% of respondents noted an increase in sensors calibrating during road tests after alignments, reducing the need for equipment-based procedures. This trend indicates a shift toward more efficient, less resource-intensive repair processes.

The data underscores that while ADAS repairs pose significant technical and operational challenges, most shops are adapting successfully, maintaining business continuity with minimal disruption. This resilience highlights the industry’s ability to evolve in response to the growing prevalence of advanced vehicle technologies.

Interested in Independent Auto Repair Shop Private Label/Store Brand Parts Purchasing Data?

Call 630-654-1079 or submit a contact form to find out how IMR research can help your business.

Learn More About Automotive Repair Shop Market Research

If you enjoyed this article, please check out some additional posts

Impact of Battery Electric Vehicle and Hybrid Electric Vehicle Repair and Service at Independent Repair Shops (Update 2022)

Current and Future Challenges for Independent Repair Shops – 2022

Effects of Supply Chain Disruptions on Independent Automotive Repair Shops

E-Commerce Purchasing Behavior at Independent Auto Repair Shops

Impact of Battery Electric Vehicle And Hybrid Electric Vehicle Repair and Service at Independent Repair Shops

The Importance of Private Label and National Branded Parts at Independent Auto Repair Shops

Update: Private Label/Store Brand Parts Purchasing by Independent Auto Repair Shops

2020 EOY Independent Automotive Repair Shop Health & Part Delivery Disruption Update

Private Label/Store Brand Parts Purchasing by Independent Auto Repair Shops

Delayed Vehicle Maintenance | Q1 – Q2 2020

Challenges for Independent Repair Shops and Technicians the Remainder of 2020 (COVID-19 Update)

Disruption in Auto Parts Availability Affecting Repair Shop Purchasing Behavior

Automotive Parts & Service Consumer Purchasing Behavior During an Economic Downturn