Current and Future Challenges for Independent Repair Shops – 2022

Read updated study: March 2023 – Current Challenges for Independent Automotive Repair Shops – 2023

At the beginning of 2022, IMR surveyed independent automotive repair shops to get insight into what they believe their biggest challenges will be in 2022 as well as what challenges they expect to face in the future.

Not surprisingly, the challenges they expect to face this year are markedly different than when these questions were asked during the pandemic as well as when asked prior to the pandemic.

About this research: Between February 1st and February 28th, 2022 IMR interviewed 500 independent repair shops, nationally representative by location in the U.S., to gain insights into the challenges repair shops expect to face in 2022 and what future challenges they see on the horizon.

For reference, in 2019, prior to the pandemic, independent repair shops listed their biggest challenges as Finding time for hands-on technician training (42.6%), Staying up to date with advances in diagnostics (31.6%), keeping up with advances in vehicle technology (31.1%) and finding good, knowledgeable and motivated technicians (29.2%).

In 2020, during the height of the pandemic, independent repair shops noted their biggest challenges were: Keeping staff/customers safe/Social distancing (55.0%), Getting customers/Keep shop running/Return to normal hours (44.0%), Getting parts on time (34.0%), Getting parts/Finding suppliers with parts in stock (29.2%).

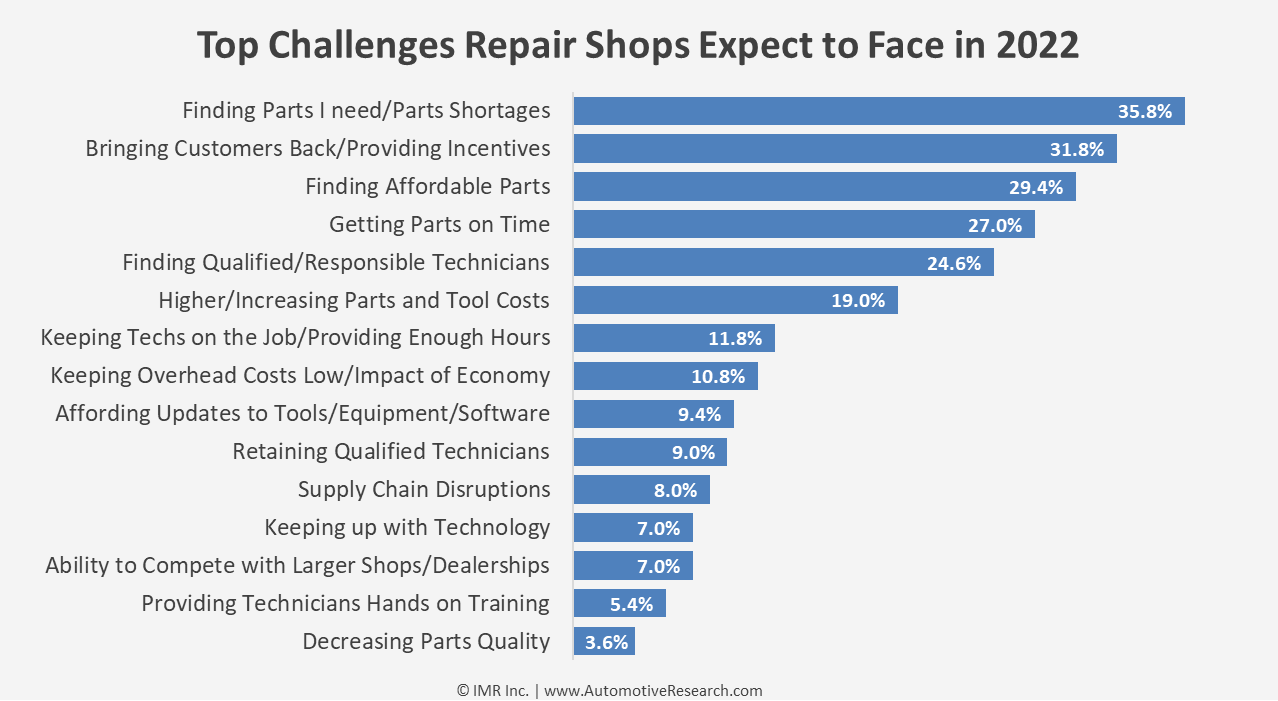

In 2022, independent repair shops state the biggest challenges they expect to face are: Finding parts I need/Parts shortages (35.8%), Bringing customers back/Providing incentives (31.8%), Finding affordable parts (29.4%), Getting parts on time (27.0%).

In total, the challenges auto repair shops expect to face mention finding needed parts, bringing customers back, parts affordability and getting parts on time. However, when we look at the results by bay size it shows that different size shops expect to grapple with the same issues but in a different ranking.

For example, the number one ranked issue for shops with 1 to 3 bays is finding qualified/responsible techs which happens to be the number two ranked issue for shops with 8+ bays.

Additionally, while Finding parts I need/Parts shortages is the largest concern, only 8.8% of shops with 1 to 3 bays note the concern, compared to 41.9% of shops with 4 to 7 bays and 50.0% of shops with 8+ bays. Bringing customers back/Providing incentives was less of a concern amongst shops with 1 to 3 bays (13.7%), shops with 4 to 7 bays (38.3%) and shops with 8+ bays (20.0%) expect it to be more of a challenge in 2022.

On average, shops with 1 to 3 bays mentioned 2.3 challenges, shops with 4 to 7 bays mentioned 2.6 challenges and shops with 8+ bays mentioned 3.0 challenges.

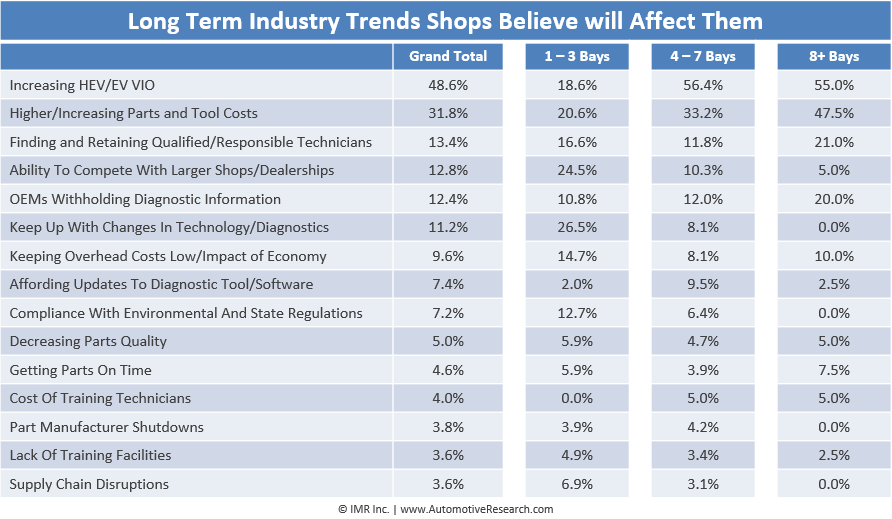

Smaller automotive repair shops with 1 to 3 bays don’t consider and increasing HEV/EV VIO to be as much of a future trend that will affect them as much as they do with the need to keep up with changes in technology and diagnostics and having to compete with larger shops.

An increasing HEV/EV VIO seems to be top of mind for shops with 4 or more bays. It the number one future trend they believe will affect them. When we released our BEV/HEV insight in July 2021, only 40% of shops believed an increasing BEV/HEV VIO would affect them in the next two years and 30% had made investments in training for their technicians.

Learn More About IMR’s Continuing Consumer Automotive Maintenance Survey (CCAMS)

Interested in automotive market research?

Call 630-654-1079 or submit a contact form to find out how IMR research can help your business.If you enjoyed this article, please check out some additional posts

Effects of Supply Chain Disruptions on Independent Automotive Repair Shops

E-Commerce Purchasing Behavior at Independent Auto Repair Shops

Impact of Battery Electric Vehicle And Hybrid Electric Vehicle Repair and Service at Independent Repair Shops

The Importance of Private Label and National Branded Parts at Independent Auto Repair Shops

Update: Private Label/Store Brand Parts Purchasing by Independent Auto Repair Shops

2020 EOY Independent Automotive Repair Shop Health & Part Delivery Disruption Update

Private Label/Store Brand Parts Purchasing by Independent Auto Repair Shops

Delayed Vehicle Maintenance | Q1 – Q2 2020

Challenges for Independent Repair Shops and Technicians the Remainder of 2020 (COVID-19 Update)

Disruption in Auto Parts Availability Affecting Repair Shop Purchasing Behavior

Automotive Parts & Service Consumer Purchasing Behavior During an Economic Downturn

Challenges for Independent Repair Shops and Technicians in 2020