Effects of Supply Chain Disruptions on Independent Automotive Repair Shops

In August 2021, IMR interviewed 500 independent automotive repair shops, nationally representative by location in the U.S., to get insights on whether supply chain disruptions were affecting their business and customers.

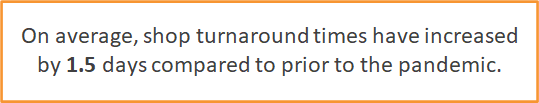

When comparing their business prior to the pandemic, 100% of shops reported that it’s taking them longer to complete vehicle service and repairs. More specifically, 85.0% of shops report that it’s taking ‘a little longer’ to complete vehicle service or repairs while 15.0% of shops say it’s taking ‘a lot longer’. On average, independent repair shops report that their vehicle turn-around time has increased by a day and a half.

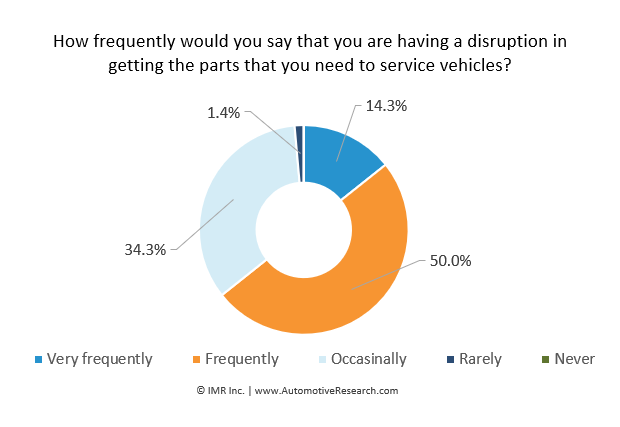

While 50% of shops state they are ‘frequently’ having disruptions in getting the parts they need to service vehicles and another 34.3% of shops say the are ‘occasionally’ having disruption in getting the parts they need, there are other contributing factors to the increased vehicle turn-around times.

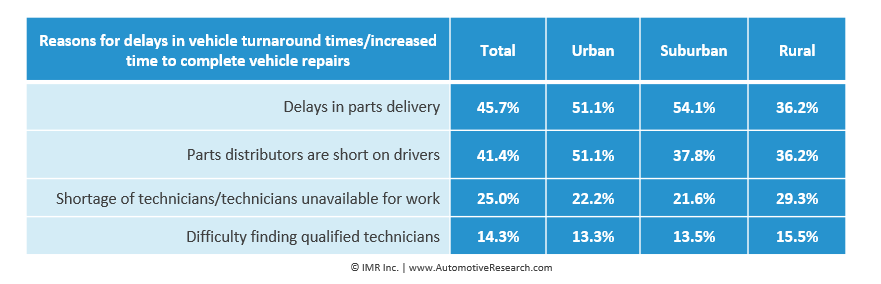

When asked what are the primary factors that are causing the delays, the top reasons given were: delays in part deliveries (45.7%), part distributors are short on drivers (41.4%), shortage of technicians/unavailable for work (25.0%), and difficulty in finding qualified technicians (14.3%). Rural shops tend to have less issues with delays in parts deliveries (36.2%) and cite a higher issue with a shortage of technicians (29.3%) compared to urban (22.2%) and suburban (21.6%) shops. Urban shops are most affected by distributors being short on drivers (51.1%) compared to suburban (37.0%) and rural shops (37.0%).

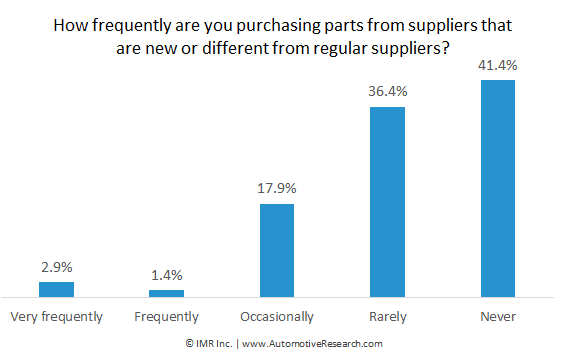

Interestingly, while there are delays, independent auto repair shops are not using alternate suppliers to get parts in a more timely manner. The majority of shops (87.8%) are rarely or never purchasing from suppliers that are new or different than their regular/primary suppliers. As noted in a prior insight on ecommerce purchasing published in August 2021, shops use of publicly available websites to get parts has declined since it’s height during the 2020 pandemic.

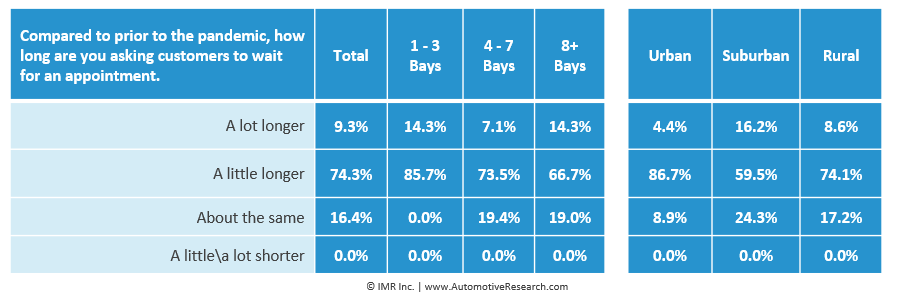

Ultimately, this increased turn-around time for vehicle service and repair has caused shops to spread out and delay customer appointments. Currently, 74.3% of shops are asking their customers to wait ‘a little longer’ for an appointment to bring their vehicle in for service or repair. The majority of shops with 1 – 3 bays (85.7%) are asking customers to wait ‘a little longer’ for an appointment to bring their vehicle in for service or repair compared to shops with 4 – 7 bays (73.5%) and shops with 8+ bays (66.7%). Shop location matters as well. Urban shops (86.7%) are asking customer to wait ‘a little longer’ for an appointment to bring their vehicle in for service or repair compared to suburban shops (59.5%) and rural shops (74.1%).

Learn More About IMR’s Continuing Consumer Automotive Maintenance Survey (CCAMS)

Interested in automotive market research?

Call 630-654-1079 or submit a contact form to find out how IMR research can help your business.If you enjoyed this article, please check out some additional posts

E-Commerce Purchasing Behavior at Independent Auto Repair Shops

Impact of Battery Electric Vehicle And Hybrid Electric Vehicle Repair and Service at Independent Repair Shops

The Importance of Private Label and National Branded Parts at Independent Auto Repair Shops

Update: Private Label/Store Brand Parts Purchasing by Independent Auto Repair Shops

2020 EOY Independent Automotive Repair Shop Health & Part Delivery Disruption Update

Private Label/Store Brand Parts Purchasing by Independent Auto Repair Shops

Delayed Vehicle Maintenance | Q1 – Q2 2020

Challenges for Independent Repair Shops and Technicians the Remainder of 2020 (COVID-19 Update)

Disruption in Auto Parts Availability Affecting Repair Shop Purchasing Behavior

Automotive Parts & Service Consumer Purchasing Behavior During an Economic Downturn

Challenges for Independent Repair Shops and Technicians in 2020

Cell Phone Usage in Bays at Independent Repair Shops